Over the last decade, technological innovation has transformed the way businesses operate. From automation to cloud-based solutions, digital tools have opened the door to streamlined workflows and smarter financial management.

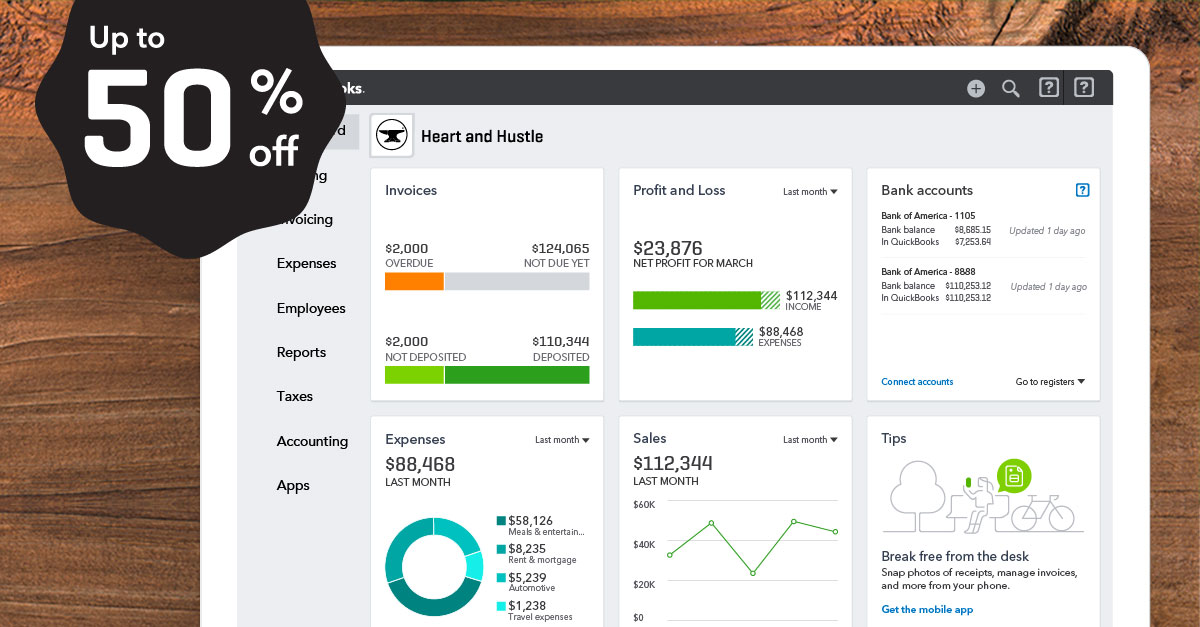

Among these tools, QuickBooks Online continues to stand out — especially for small businesses. Its user-friendly interface, powerful features, and reliable performance have made it one of the top choices for entrepreneurs, freelancers, and growing companies.

So , let’s know what exactly this software is, what are its features, and a lot more with clarity in the Quickbooks review post.

What is Quickbooks Online?

QuickBooks Online is a cloud-based accounting software designed for small to mid-sized businesses, self-employed professionals, and even independent accounting firms. It helps manage your books with tools for:

- Invoicing and payment tracking

- Expense and sales monitoring

- Tax calculations and reporting

- Time tracking and payroll integrations

The platform features a centralized dashboard that gives users clear insights into business performance through Key Performance Indicators (KPIs). This makes it easier to identify emerging trends and make data-driven decisions for growth.

Over the years, QuickBooks has continued to evolve with regular updates and feature enhancements. Recent improvements include advanced project management tools and more flexible invoicing features, making it even more valuable for growing businesses.

Originally launched in 2002, QuickBooks Online now supports over 2.2 million active users, earning its reputation as one of the leading solutions in the accounting software space.

Pros and Cons

While QuickBooks Online brings a wide array of advanced features, it still has some shortcomings that users should be aware of. Navigational challenges, frequent price hikes, and less-than-stellar customer support are common concerns. Many users have reported long wait times for assistance and occasional upselling within the platform.

Additionally, the recent pricing revisions have made it a more expensive choice for some small businesses trying to manage tight budgets.

That said, QuickBooks continues to shine in several key areas. It’s considered an industry standard among accountants and offers a comprehensive toolkit that includes detailed reporting, customizable invoices, support for multiple currencies, and robust inventory tracking. With over 750 app integrations, the software is highly flexible and scalable.

Beyond these features, QuickBooks also includes unique offerings like QuickBooks Capital, a lending platform for small businesses, and QuickBooks Live Bookkeeping, an optional add-on that connects users with professional bookkeepers to manage their accounts.

And despite minor navigation issues, QuickBooks Online remains relatively easy to learn and use — making it a reliable choice for many small businesses.

Quickbooks Online Features

QuickBooks Online offers multiple pricing plans, and the features vary accordingly. While premium features are reserved for the higher-tier plans, several core functionalities are included across all versions. Here’s a breakdown of the most notable features you can expect:

✔Taxes

✔Expenses

✔Cloud Accounting

✔ Sales

✔ Report

✔Online Banking

✔Multiple Users

✔Support

✔Time -tracking

✔Inventory Management

✔Integrations

1. Taxes

This feature of QuickBooks Online lets you track the tax amount for all the sales you’ve made. With the “sales tax owed” option, you can easily monitor relevant sales, taxable sales, and the assessed tax amount.

Additionally, you can track payments, due amounts, and even add unlimited sales tax rates as needed.

While creating a new invoice, you can also attach a new tax rate to it for better accuracy.

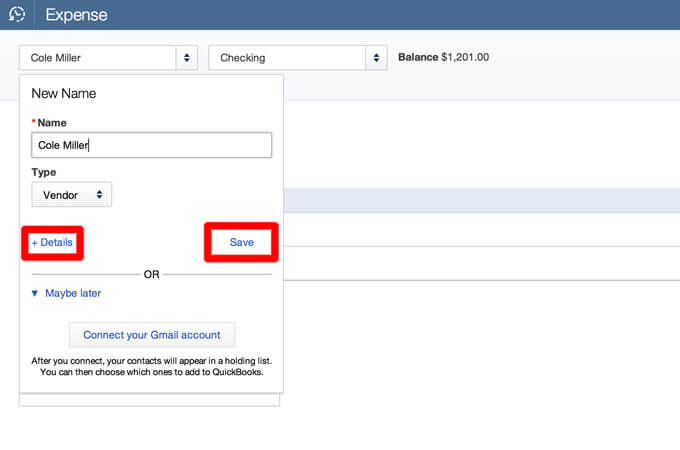

2. Expenses

The Expenses feature allows you to manage all your vendors and their bills so that you only pay the due amount. You can also save time by scheduling recurring payments.

In addition to these, you’re allowed to print checks and sort your expenses by date, vendor, or payment status.

Bonus: You can even track and categorize expenses automatically via bank feeds or the mobile app, helping you manage everything on the go.

Also Check :

Is FreshBooks A Good Free QuickBooks Alternative? -FreshBooks Review

Gusto Review 2026: A Comprehensive Look At Gusto Payroll Software

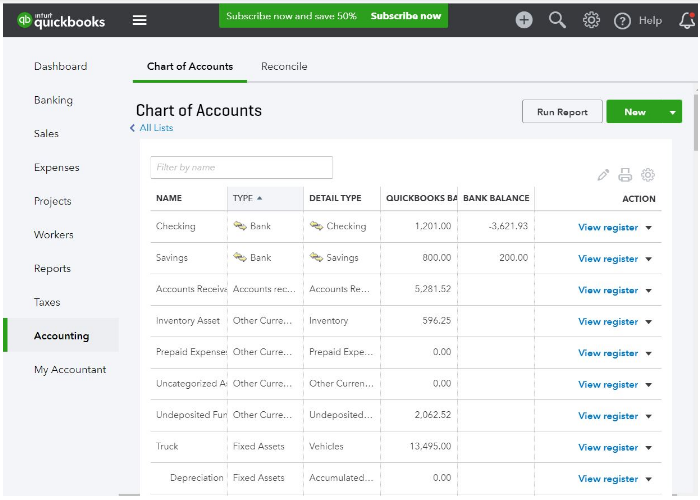

3. Accounting

The Accounting section is where you can manage all your accounts, reconcile credit cards and bank statements, and track transactions across multiple accounts.

With the standard QuickBooks Online plan, you can add up to 250 accounts, with upgraded plans offering even more.

The reconciliation feature simplifies the process, ensuring accuracy and compliance.

Additionally, cloud accounting keeps all your financial data secure and accessible from anywhere.

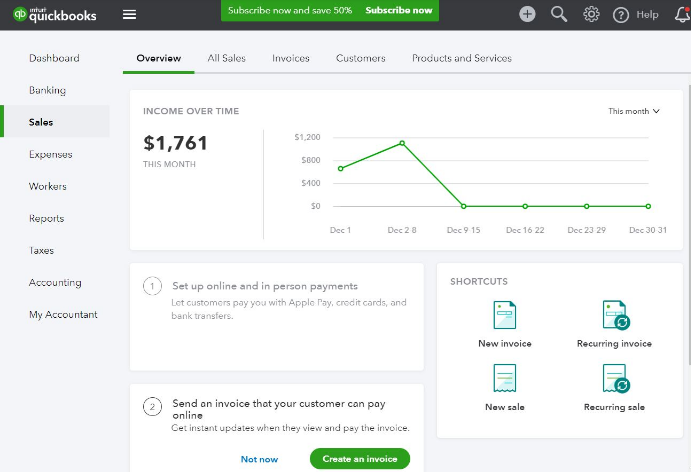

4. Sales

Using the Sales feature, you can track your customers, create new invoices and estimates, post payments, and check the status of existing invoices.

Send payment reminders, invoice links, and accept online payments with ease.

It also integrates seamlessly with Mailchimp, allowing for email-based follow-ups and marketing.

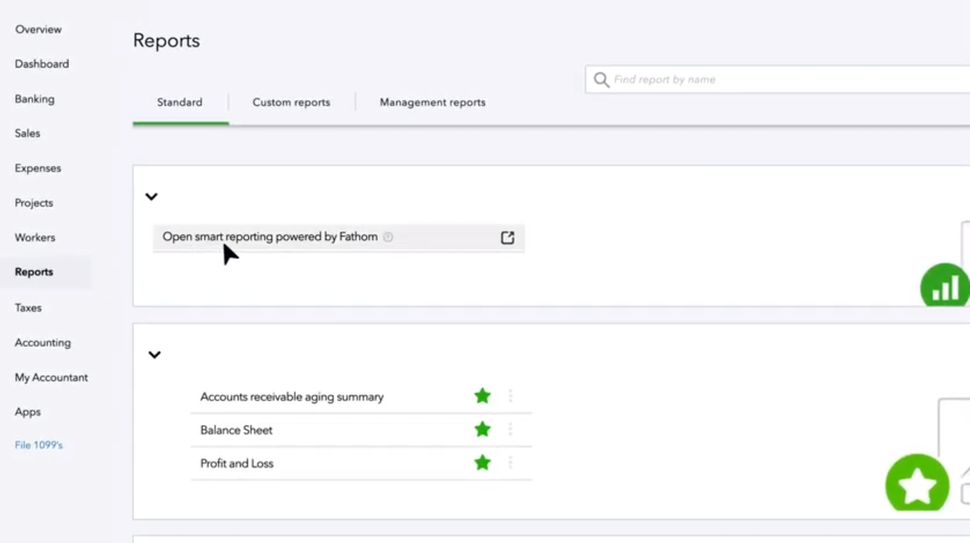

5. Report

QuickBooks Online enables you to see how your business is performing through customizable reports categorized as:

- Business Overview

- Favorites

- Expenses and Vendors

- Sales Tax

- What You Owe

- Who Owes You

- Employees

- Sales and Customers

- For My Accountant

You can save reports, schedule them for future access, email them, or export them to Excel or PDF.

These insights are essential for understanding cash flow management and financial health.

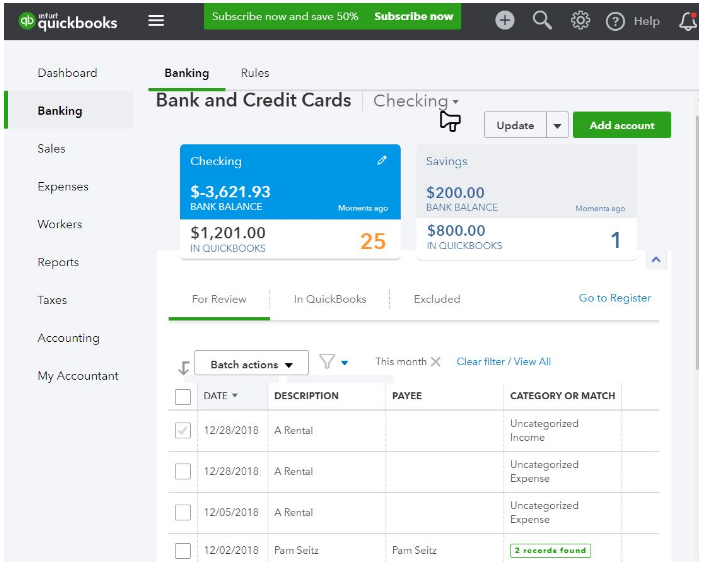

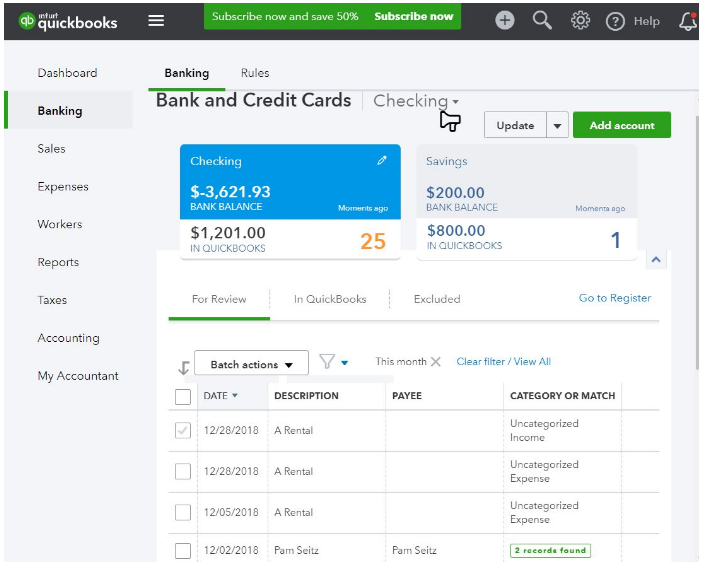

6. Banking

The online banking integration feature allows you to manage your connected financial institutions, auto-update transactions, and view account summaries.

You can add more bank accounts as needed, and the Business Checking Account functionality provides a streamlined solution for separating business and personal finances.

7. Employees

QuickBooks allows you to track both employees and contractors, manage permissions, and control access levels.

Features like direct deposit and employee timesheets ensure accurate payroll and time tracking.

Collaborate easily by inviting users to view or manage the books—perfect for teams and accountants.

8. Support

From bank feeds to product setup, QuickBooks Online offers a wealth of learning and support resources.

Access free video tutorials, training classes, and webinars.

Additionally, join the QuickBooks online community to get help from other users or consult directly with product experts.

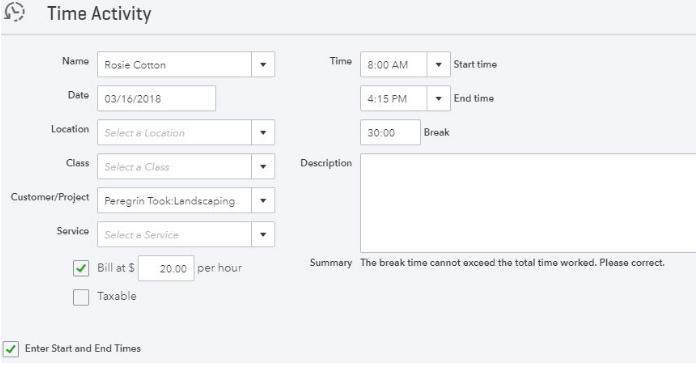

9. Time – tracking

Track employee hours and billable time through single time activities or detailed time-sheets.

Easily access this information to automatically populate invoices.

For those on the go, use the mobile app to clock in/out or log activities in real-time.

And yes, it includes a built-in mileage tracker that auto-calculates travel expenses—great for mobile teams and freelancers.

10. Inventory Management

If your business deals with products, QuickBooks Online has a robust inventory tracking system.

You can monitor stock levels, set reorder alerts, view product sales history, and sync inventory with invoices automatically.

This feature is especially helpful for eCommerce and retail businesses.

11. Integrations

QuickBooks Online connects with hundreds of third-party apps for enhanced functionality.

Whether you need CRM, time tracking, eCommerce, or analytics tools, the QuickBooks Integrations marketplace covers it all.

Top integrations include PayPal, Shopify, HubSpot, Square, and more—so you can create a customized financial ecosystem.

Limitations

QuickBooks online accounting software for small and mid-sized businesses—affordable, user-friendly, and feature-rich. However, there are a few limitations worth noting:

- User Limits

Each plan supports a specific number of users—Simple Start allows one, Essentials three, Plus five, and Advanced up to 25. Your accountant also counts toward the limit, so plan accordingly. - Single Business per Subscription

Managing multiple businesses? You’ll need a separate subscription for each, as QuickBooks Online doesn’t support handling multiple companies under one account. - Mileage Tracking Restrictions

Mileage tracking is available only via the mobile app. The desktop version doesn’t offer this feature, so mobile access is essential if you need it. - Upgrade Flexibility

You can upgrade or downgrade plans anytime, but some features may be temporarily limited during the switch. If you anticipate growth, consider starting with a more scalable plan like Plus or Advanced.

Also Read, Is FreshBooks A Good Free QuickBooks Alternative? -FreshBooks Review

Pricing and Plans

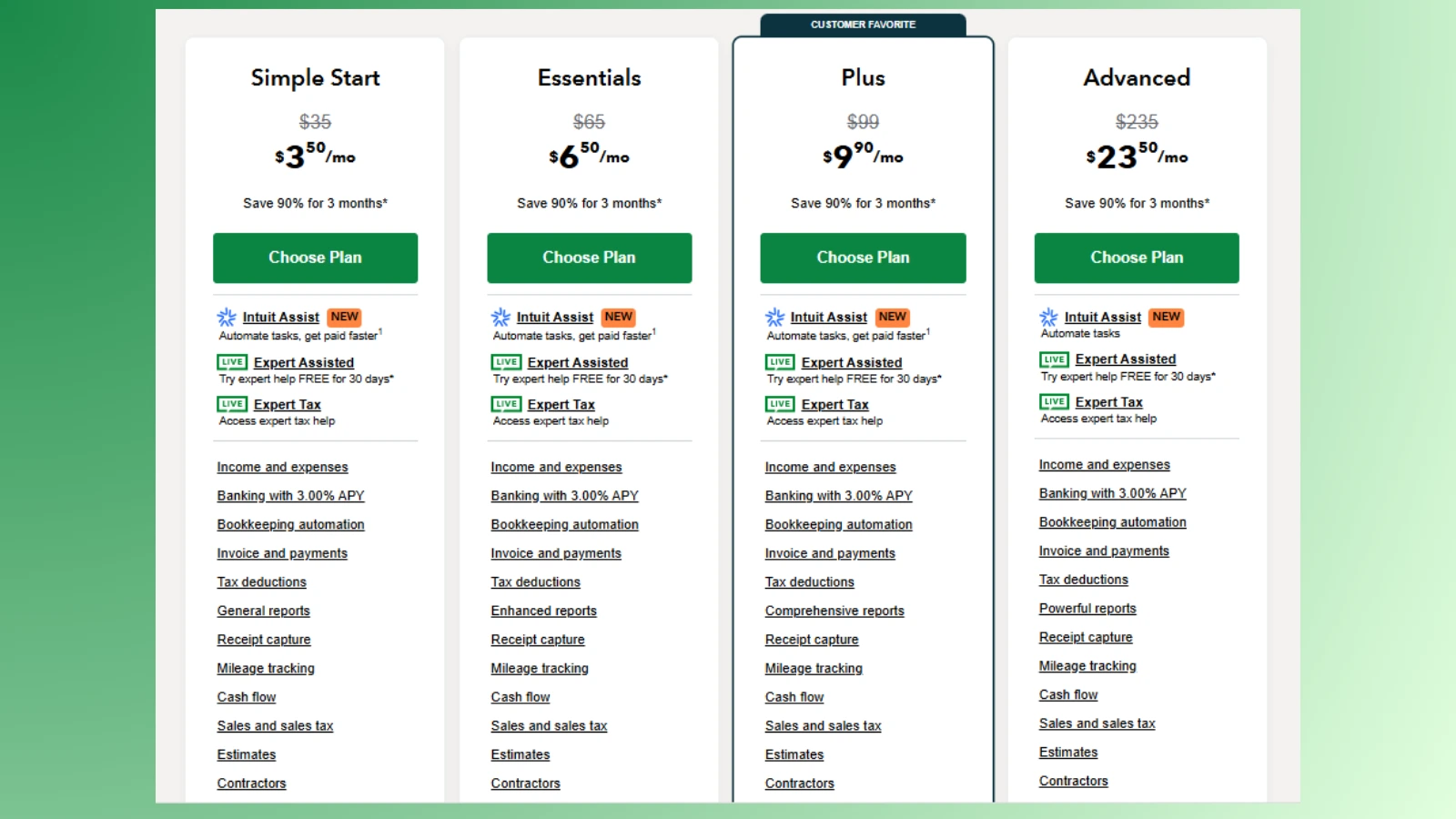

QuickBooks Online offers four flexible subscription plans tailored to meet varying business needs—Simple Start, Essentials, Plus, and Advanced. Each plan comes with expert-assisted support, and features scale up progressively to accommodate more complex accounting tasks and team sizes.

Currently, they’re offering up to 90% off for the first 3 months across all plans.

Plan Overview:

- Simple Start ($6.50/mo) – Ideal for solo entrepreneurs. Includes income/expense tracking, invoicing, mileage tracking, and tax deductions.

- Essentials ($6.50/mo) – Adds bill management, time tracking, and supports 3 users. Suitable for growing teams.

- Plus ($9.90/mo) – Includes inventory tracking, project profitability, and supports up to 5 users. Best for businesses managing multiple workflows.

- Advanced ($23.50/mo) – Designed for scaling businesses. Offers powerful analytics, workflow automation, and supports up to 25 users.

All plans include free expert help for 30 days and live tax support. For the latest pricing or to explore features in detail, visit the official QuickBooks website.

Start your free trial Now!

Final Verdict

QuickBooks Online comes packed with a wide array of features and reliable accounting tools that small business owners truly need. It also supports plenty of integrations and provides excellent customer service, making it a solid choice for small to mid-sized businesses.

Although some users may be concerned about the recent pricing increase, the software still delivers great value overall and remains a worthwhile option.